July 2025 Income Report: $1,918 Net Profit

Am I cooked?

Back to school season is here and it’s time to face the music. Did we buy correctly or are we cooked?

The first few days in August have been off to a good start, but I have way more inventory I need to sell through than I have the past two busy seasons.

And if you want to compare this months to last month, you can check out the June 2025 income report.

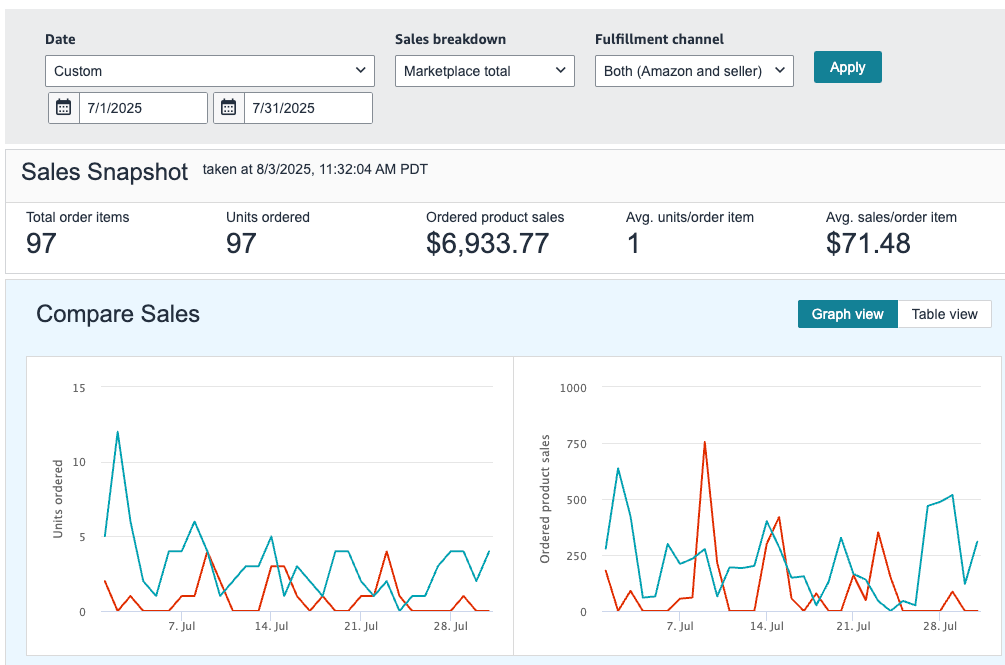

P&L for July 2025

Total Revenue: $6,933.77

COGS: $3,058.36

Biz Expense + AMZ Fees: $1,957.32

Net Profit: $1,918.09

Profit per item: $19.77

ROI: 63%

Profit margin: 28%

2025 Net Profit: $15,410.38

Yes! Good month, hope it’s a good omen for a great August. If I stop sending these posts out it’s because I got cooked. (Don’t worry I’m only half joking)

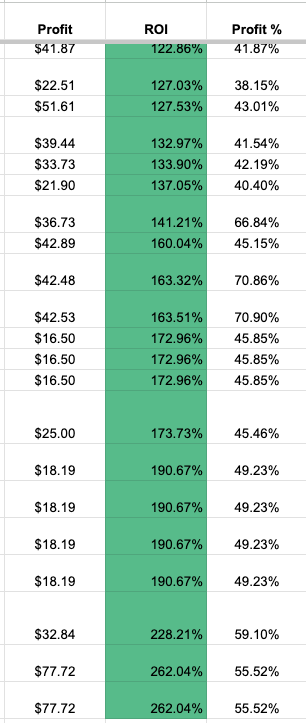

Winners

I had 30 sales that had a 100% or greater ROI. That’s so cool to see. Yea, sometimes the profit was only $6, $15, or $18. But sometimes it was $77!

Can’t always get these huge winners, but it shows the potential of Amazon.

As I start scaling to a bigger and bigger seller, I’ll have to settle for lower ROI and higher volume. But it’s still fun to see the dark green gradient and a 262% return.

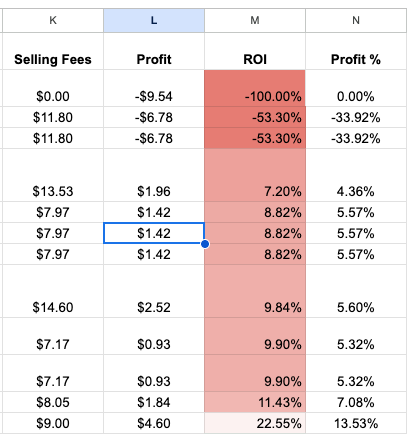

Losers

The 22% ROI isn’t really a loser, but it showed up as red on my spreadsheet so I included it.

That -100% ROI at the top is because Amazon sent out another one of my units as a “replacement” to the customer.

Can’t complain when only three sales lost money. I know I probably have some inventory that isn’t priced appropriately at the moment and will need to be sold for a loss eventually. I am still figuring out how to best track and handle those deadbeats.